Quantum computing is rapidly emerging as a game-changer in the tech industry, capturing the attention of forward-thinking investors. As this revolutionary field evolves, quantum computing stocks present an exciting opportunity to tap into the future of data processing and computational power. In this article, we explore why quantum computing is gaining traction among investors, the leading companies driving the market, and expert insights on how to identify promising stocks. Whether you’re looking to diversify your portfolio or stay ahead of technological advancements, understanding the potential of quantum computing stocks is essential for navigating this cutting-edge investment landscape.

Let’s examine this topic closely with gameslino.com

1. Why Quantum Computing Stocks are Gaining Attention

Quantum computing is poised to revolutionize various industries, from cryptography and pharmaceuticals to artificial intelligence and finance. This transformative potential is driving growing interest in quantum computing stocks among investors. As traditional computers reach their limits in processing power, quantum computers promise to solve complex problems exponentially faster, opening up new possibilities for innovation and efficiency.

Investors are drawn to quantum computing stocks because of the field’s rapid advancements and the increasing involvement of major tech companies. Giants like IBM, Google, and Microsoft are making significant investments in quantum research and development, signaling strong confidence in the technology’s future. Moreover, governments and private institutions are also pouring resources into quantum initiatives, further fueling the industry’s growth.

The promise of quantum computing extends beyond technological breakthroughs; it also represents substantial financial opportunities. Companies at the forefront of this revolution are likely to experience significant growth as quantum computing moves closer to mainstream adoption. As a result, investors see quantum computing stocks as a way to gain early exposure to what could be one of the most transformative technological advancements of the century, driving attention and investment into this burgeoning market.

2. Why Investors Should Consider Quantum Computing Stocks

Investors should consider quantum computing stocks because of the immense potential these technologies hold for future growth and innovation. Quantum computing is not just an incremental advancement; it’s a paradigm shift that could redefine industries by solving problems that are currently unsolvable with classical computers. This disruptive potential makes quantum computing companies attractive to investors looking for high-growth opportunities in the tech sector.

The market for quantum computing is still in its early stages, meaning that investors have the chance to enter before widespread adoption drives stock prices higher. Companies leading in quantum computing are not only pioneering new technologies but also forming strategic partnerships and securing significant funding, which positions them well for long-term success. Additionally, as industries like finance, healthcare, and cybersecurity begin to integrate quantum solutions, the demand for quantum technologies is expected to surge, leading to substantial returns for early investors. Thus, investing in quantum computing stocks offers a way to capitalize on the next wave of technological innovation.

3. How Quantum Computing Technology is Evolving

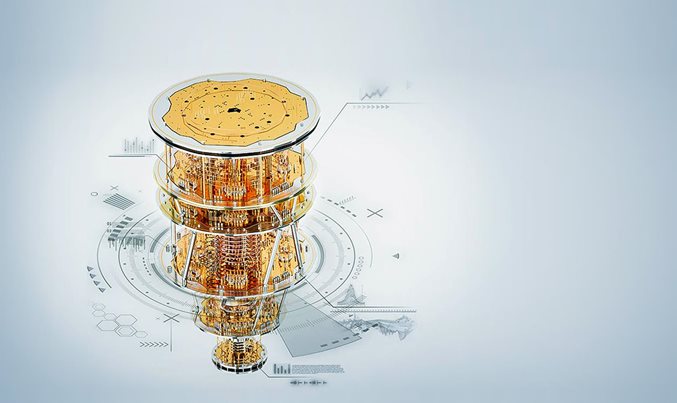

Quantum computing technology is evolving at an unprecedented pace, with advancements rapidly transforming theoretical concepts into practical applications. Initially, quantum computing was confined to academic research and small-scale experiments, but recent breakthroughs have brought us closer to realizing its full potential. The development of quantum processors with increasing qubit counts, improved error correction techniques, and more stable quantum states are key milestones driving this evolution.

One of the most significant developments in quantum computing is the achievement of quantum supremacy, where a quantum computer performs a task that would be impossible or take an impractical amount of time for classical computers. Companies like Google and IBM have demonstrated such feats, showcasing the practical viability of quantum computing for solving complex problems. Additionally, the emergence of quantum algorithms that can outperform classical algorithms in specific tasks is further solidifying the technology’s potential.

Moreover, quantum computing is becoming more accessible through cloud-based platforms, allowing researchers, developers, and businesses to experiment with quantum algorithms and applications without needing specialized hardware. This democratization of quantum computing resources is accelerating innovation and fostering a growing ecosystem of quantum startups and collaborations. As the technology continues to mature, we can expect to see quantum computing integrated into more industries, driving efficiency, security, and entirely new capabilities that were previously unimaginable.

4. How Leading Companies are Shaping the Quantum Computing Market

Leading companies are at the forefront of shaping the quantum computing market by making substantial investments in research, development, and infrastructure. Tech giants like IBM, Google, and Microsoft are spearheading advancements with their quantum computing initiatives, each focusing on developing powerful quantum processors, algorithms, and cloud-based quantum platforms. IBM, for example, has introduced the IBM Quantum Network, which allows researchers and businesses to access quantum computers via the cloud, fostering widespread experimentation and innovation.

Google’s achievement of quantum supremacy marked a pivotal moment in the industry, demonstrating the practical applications of quantum computing and setting a high bar for competitors. Microsoft, meanwhile, is developing topological qubits, which promise to be more stable and scalable than existing qubit technologies.

Beyond tech giants, companies like Rigetti Computing and D-Wave Systems are also making significant strides by offering specialized quantum hardware and software solutions tailored to specific industry needs. These companies are shaping the market by driving technological innovation, creating strategic partnerships, and making quantum computing more accessible to a broader audience, thereby accelerating the commercialization and adoption of quantum technologies.

5. How to Identify Promising Quantum Computing Stocks

Identifying promising quantum computing stocks requires a strategic approach, focusing on companies that are leading in innovation, partnerships, and long-term potential. Start by looking at established tech giants like IBM, Google (Alphabet), and Microsoft, which have made significant investments in quantum computing. These companies have the resources and expertise to continue driving advancements and are likely to maintain leadership in the field.

In addition to large tech firms, consider smaller companies and startups that specialize in quantum computing technology. Companies like Rigetti Computing and IonQ are dedicated exclusively to quantum development and have shown strong growth potential. Evaluating these companies involves assessing their technological capabilities, patent portfolios, and the quality of their partnerships with academic institutions or industry leaders.

Another key factor is the company’s roadmap for commercialization. Promising quantum computing stocks are those where the company is not just innovating but also actively working towards integrating quantum solutions into real-world applications. This includes partnerships with industries like finance, pharmaceuticals, and cybersecurity, where quantum computing can provide a competitive edge.

Lastly, keep an eye on government support and funding, as this often signals confidence in a company’s potential. Stocks of companies that are recipients of significant grants or contracts for quantum research can be good indicators of future growth prospects in the quantum computing sector.

6. What Industry Experts Predict for Quantum Computing Stocks

Industry experts predict that quantum computing stocks will experience significant growth as the technology progresses from research labs to practical applications. Analysts expect that as quantum computing moves closer to commercialization, companies leading in this field will see substantial increases in their market valuations. Experts believe that quantum computing will revolutionize industries like finance, healthcare, and cybersecurity by enabling solutions to problems that are currently unsolvable by classical computers.

The timeline for widespread adoption is still uncertain, with most experts estimating that it could take another 5 to 10 years before quantum computing becomes mainstream. However, they also emphasize that early investment in quantum computing stocks could yield high returns as the technology matures.

Experts also highlight the importance of diversification within quantum investments. Rather than focusing solely on one or two companies, they suggest spreading investments across a range of firms involved in different aspects of quantum technology, such as hardware development, software solutions, and quantum services. This strategy can help mitigate risks associated with the uncertainty of which companies will ultimately dominate the quantum computing landscape.

7. What Challenges Investors Might Face in Quantum Computing Stocks

Investing in quantum computing stocks comes with several challenges that investors should carefully consider. One major challenge is the high level of technological uncertainty. Quantum computing is still an emerging field, and predicting which technologies and companies will ultimately succeed is difficult. Many quantum computing ventures are in the experimental phase, and their long-term viability remains uncertain.

Another challenge is the significant capital and time required to develop and commercialize quantum technologies. Quantum computing research and development require substantial investment, and it may take years before these technologies generate substantial revenue or profits. This long timeline can lead to market volatility and unpredictable stock performance.

Additionally, the competitive landscape is intense, with numerous companies and research institutions vying to achieve breakthroughs. This competition can result in rapid technological changes and shifts in market leadership, adding to the risk for investors.

Regulatory and ethical considerations also pose challenges. As quantum technologies advance, they may face regulatory scrutiny and ethical debates, which could impact stock performance.

Finally, the niche nature of quantum computing means that market liquidity can be low, making it harder to buy or sell stocks without affecting their price. Investors need to navigate these challenges with caution and thorough research.

8. What Potential Returns Investors Can Expect from Quantum Computing Stocks

Investors in quantum computing stocks could see substantial returns as the technology advances and begins to reshape industries. Early-stage investments in leading quantum computing companies have the potential for high rewards, particularly as the technology moves towards commercialization. Analysts anticipate that successful companies in this sector could experience significant growth in stock value as they achieve key milestones such as technological breakthroughs, partnerships with major industries, and successful product launches.

The potential returns are driven by quantum computing’s transformative capabilities, which promise to address complex problems and create new market opportunities in fields like finance, healthcare, and cybersecurity. As quantum computing becomes more integrated into various industries, demand for innovative solutions will likely increase, benefiting early investors.

However, it’s important to remember that these potential returns come with high risk due to the nascent stage of the technology and the uncertainties involved. Investors should weigh the high reward potential against the inherent risks and volatility associated with quantum computing stocks.

9. What Resources and Tools are Available for Investing in Quantum Computing Stocks

Investors looking to engage in quantum computing stocks have several resources and tools at their disposal. Financial news platforms and investment research websites offer up-to-date information on quantum computing companies, market trends, and expert analyses. Websites like Bloomberg, Reuters, and CNBC provide valuable insights and updates on developments within the quantum computing sector.

Investment research firms and financial advisors specializing in technology sectors can offer tailored guidance and stock recommendations based on in-depth analysis. Tools such as stock screening software and market analysis platforms like Morningstar and Yahoo Finance help investors track stock performance and evaluate potential investments.

Additionally, investor forums and industry reports from organizations such as the International Quantum Computing Association can provide valuable perspectives and networking opportunities. For those interested in direct investments, quantum computing-focused exchange-traded funds (ETFs) and venture capital funds offer diversified exposure to the sector. Utilizing these resources can help investors make informed decisions and strategically invest in quantum computing stocks.

Quantum computing stocks represent a dynamic and promising investment opportunity, driven by technological breakthroughs and growing industry interest. While challenges and uncertainties remain, the potential for significant returns makes this sector an exciting prospect for forward-thinking investors. By leveraging available resources and staying informed about industry developments, investors can strategically navigate the evolving landscape of quantum computing.

gameslino.com